A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Most joint ventures are incorporated, although some, as in the oil and gas industry, are "unincorporated" joint ventures that mimic a corporate entity. Key elements of a joint venture's design include:

- the number of parties

- the geographic, product, technology and value-chain scope within which the JV will operate

- the contributions of the parties

- the structural form (each country has specific options, e.g. in the U.S. the main options are a C Corporation or an LLC/partnership structure)

- the valuation of initial contributions and ownership split among the parties

- the economic arrangements, post-deal (e.g. Is the joint venture intended to general profits vs. operate as a cost-sharing or production-sharing venture; if a for-profit entity, will the parties share profits in proportion to equity ownership, or some other way?)

- governance and control

- Talent/HR model (will the Jv have its own staff on own payroll vs. second staff from the parent companies

- contractual arrangements with the parent companies for inputs, outputs or services

- exit and evolution provisions?

According to the Vietnamese state law, a joint venture can be incorporated as a limited liability company or a joint-stock company (if there are more than 3 investors/parties). Each party is responsible for the company within the scope of its capital contribution to the charter capital of the company.

A joint venture with legal entity under the laws of Vietnamese state, founded and operated from the date of issuance of investment certificate of registration and certificate of business registration.

Every years, there are many investors coming to Vietnam to establish a joint venture. Howevers, most of them are not farmiliar with legal procedures of the country, which leads to arised problems. Therefore, the Vietnam National Law would like to help you easily complete these complicated legal procedures. Once contacting the Vietnam National Law Consultancy, you will be consulted by professional lawyers on every aspects related to the joint venture. Then, the company will represent you to complete every procedures following the state law.

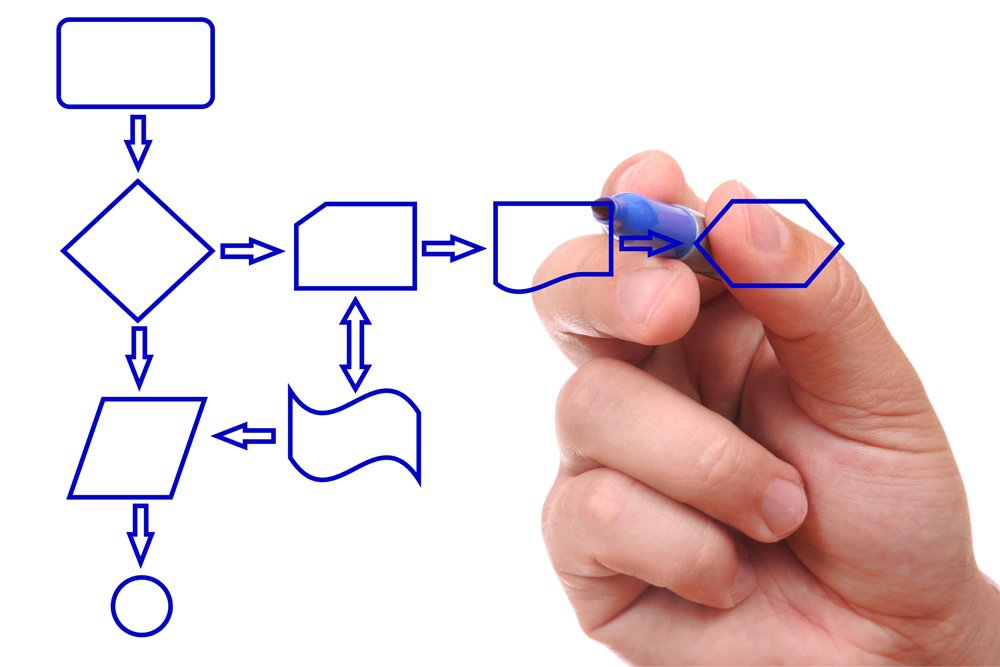

THE PROCEDURES

In order to establish a foreign-owned company in Ho Chi Minh city, you must obtained the Investment Certificate issued by Department of Planning and Investment of Ho Chi Minh City and approved by People's Committee of Ho Chi Minh city. Then, the Vietnam National Law Consultancy Company will give you advices and guidance to comply with the following procedures:

Step 1: Prepare the necessary documents

The Vietnam National Law Consultancy Company will send you the list of documents that you need to provide (according to the list below). During the process of providing, if you have any questions, please contact us via email and phone in order that we can consult directly on these proceduces.

Step 2: Complete the relevant documents.

After receiving the documents that you provided, the Vietnam National Law Consultancy Company will complete the necessary documents.

Step 3: Proceed to send all documents in order that you can check and sign carefully on them.

Step 4: On behalf of customers submission and settlement documents until you are granted Investment Certificate and Business Registration Certificate.

DOCUMENTS REQUIRED

Please prepare documents as follows:

1. Documents to Prove Lawful Source of Investor

1.1. For Company Investor

→ A Copy of the company's license (or any equivalent document) (These documents must be consular legalized)

→ Financial Statements (Audited) (These documents must be consular legalized)

→ Audited Company Accounts (These documents must be consular legalized)

→ Charter of company / Memorandum of Association of Company (These documents must be consular legalized)

→ Authenticated Copy of the representative's passport.

Notes: These documents from oversea must be consular legalized and translate into Vietnam.

1.2. If the investor is an individual:

→ Authenticated Copy of the investor passport.

→ Audited Company Accounts (These documents must be consular legalized )

Notes: These documents from oversea must be consular legalized and translate into Vietnam.

2. Capacity Profiles of Investor(s)

In addition to legal documents, a Capacity Profile of Investor(s) is essential to demonstrate the capability of the investor when performing these operations. However, there are no a general form of Capacity Profiles and you should send them to us to be reviewed before being put to use.

Please send some of the import-export contracts between your company and your customer and their relevent documents. In your application to set up a company, we want to let the Vietnam goverment know that your company have experience in trading. Therefore, your plan will be easily accepted.

Notes: These documents from oversea must be consular legalized and translate into Vietnam.

3. Documents to Prove the company headquarter and the place of implementing the projects

Legal documents concerning housing and land of the company headquarter and the place of implementing the projects.

Depend on Business line

SERVICE CHARGES

Depend on Business line

|

No.

|

Business line |

Unit cost

|

|

1

|

Service |

Please Call or email

|

|

2

|

Import – Export |

Please Call or email

|

|

3

|

Wholesale Distribution |

Please Call or email

|

|

4

|

Retail Distribution |

Please Call or email

|

|

5

|

Construction |

Please Call or email

|

|

6

|

Manufacturing |

Agreement

|

|

7

|

Special Business |

Agreement

|

|

8

|

Major Capital Projects |

Agreement

|

WHY CHOOSE US?

1. The Vietnam National Law Consultancy Company charges no fee when consulting issues (listed below) related to establising a foreign-owned company:

- The hierarchy structure of the company;

- The title of the company;

- The mode of operation of the company ;

- The business line(s) of the company;

- Rights and obligations of shareholders in the company;

- The ratio and method of capital contribuition of shareholders;

- Other related issues.

2. The Vietnam National Law Consultancy Company support customers in completing documents for business registration:

- Documents for business registration as a joint sotck company;

- Documents for business registration as a one-member limited liability company;

- Documents for business registration as a limited liability company;

- Documents for business registration as a partnership;

- Documents for business registration as a joint sotck company;

- Documents for business registration as a private enterprise;

- Practicing certificate and documents of legal capital and business condition.

3. The Vietnam National Law Consultancy Company represents customer to work on legal procedures:

- Submit the documents for business registration to the state authorities;

- Track the handling process after the submission and send a notice about the result of the submission to customer;

- Receive the business license (including the tax code) at the Department of Planning and investment of Ho Chi Minh city;

- Submit the documents for seal specimen registratrion and contact agencies for seal carving based on the specimen.

- Receive the Certificate of Seal Specimen Registration and the company's seal.

4. After-sales service - After the contract works are completed, the Vietnam National Law Consultancy Company will also:

- Provides customer forms of documents and contracts.

- Provides internal company documents;

- Provides legal documents often.

- Provides free consultation during the operation period of the company.

- Provides 10% discount for the next services

If you have any inquiries or would like to request for further information, please contact us by calling or sending us an email. We will attend to your request as soon as possible.

The Vietnam National Law Consultancy Company - The leading and highly recommended business law firm in Vietnam.

HO CHI MINH CITY OFFICE

*District 1 Office:

-

Address: No.85 Hoang Sa Street, Da Kao Ward, District 1, Ho Chi Minh city, Vietnam.

-

Hours of Operation: Monday - Friday from 08:00 - 17:00 ( 8:00 AM - 5:00 PM )

-

Telephone: (028) 38 20 2929 (20 Line)

-

Hotline: 0948 68 2349

-

Email: vanphonghcm@quocluat.vn

HA NOI CITY OFFICE

-

Address: The building of Agricultural Garment Co. No. 1/12 Truong Chinh Street, Phuong Mai Ward, Dong Da District, Hanoi city, Vietnam.

-

Hours of Operation: Monday - Friday from 08:00 - 17:00 ( 8:00 AM - 5:00 PM )

-

Telephone: (028) 38 20 2929 (20 Line)

-

Hotline: 0948 68 2349

-

Email: vanphonghn@quocluat.vn

Vietnamese

Vietnamese English

English

Tổng lượt bình luận: - Tổng lượt trả lời: